Opening modes

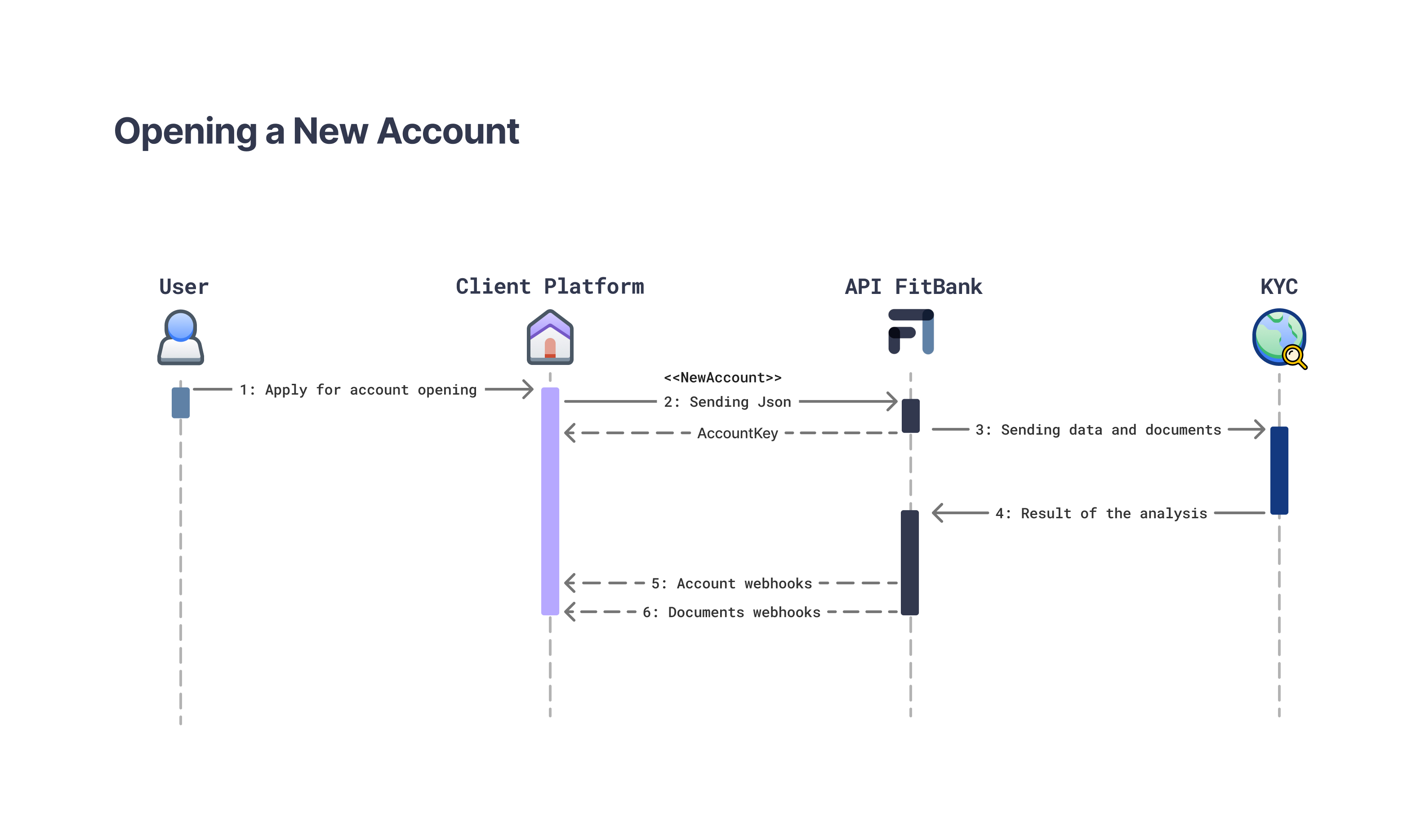

The beginning of the account opening process requires the sending of the customer's registration data, along with the necessary identification documentation. This request can be made through a form or the API, using the:

New Accountor LimitedAccount

In this way, it is possible to start the registration process quickly and efficiently, ensuring the security and accuracy of the information provided by the customer.

In order to comply with regulations imposed by regulatory agencies, it is necessary for the customer to read and understand the account opening terms before initiating any banking transaction. This measure is important to ensure that the customer is aware of the applicable terms and conditions for the financial service in question and can make informed decisions. In addition, reading and acknowledging the account opening terms also protects Fitbank from possible disputes or legal disputes. Therefore, it is essential that the account opening terms be presented in a clear and accessible manner to customers, so that they can fully understand their rights and responsibilities when using financial services. To access the terms, please contact the Fitbank support team.

To learn about the service's webhooks, visit the page

Service catalog (SLA)

| Services | SLA (Hours/Days) | Description |

|---|---|---|

| Full Corporate Account Opening | Within 3 business days. | Full corporate account opening is completed within 3 business days. |

| Full Natural Person Account Opening | Within 3 hours. | Full natural person account opening is completed within 3 continuous hours. |

| Limited Natural Person Account Opening | Within 3 hours. | Limited natural person account opening is completed within 3 continuous hours. |

| Limited Account Opening for Legal Entities | Within 3 hours. | The limited account opening for legal entities is completed within 3 continuous hours. |

| Account Closure | Within 48 business hours. | The SLA for account closure is up to 48 business hours. |

Updated over 1 year ago